reverse sales tax calculator nj

1 2018 that rate decreased from 6875 to 6625. Reverse Sales Tax Formula.

Maximum Local Sales Tax.

. Here is the Sales Tax amount calculation formula. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Bekijk schermafdrukken lees de recentste klantbeoordelingen en vergelijk.

Divide tax percentage by 100 to get tax rate as a decimal. Reverse Sales Tax Calculator Of New Jersey For 2022. All examples are hypothetical and are intended for illustrative purposes only.

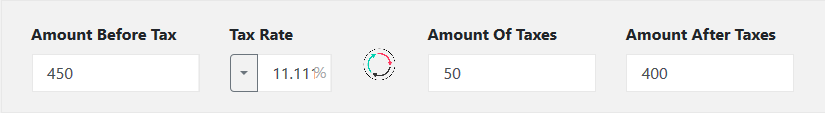

The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Reverse Sales Tax Calculations.

This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Numbers represent only state taxes not federal taxes.

If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax. That entry would be 0775 for the percentage. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Sales and Use Tax. Average Local State Sales Tax. In other words if the sales tax rate is 6 divide the sales taxable receipts by 106.

You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax. As well as entrepreneurs and anyone. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202122.

As well as entrepreneurs and anyone else who may need to figure out just how. Price before Tax Total Price with Tax - Sales Tax. Sales and Gross Receipts Taxes in New Jersey amounts to 163 billion.

Get in Store app. Amount without sales tax GST rate GST amount. Maximum Possible Sales Tax.

Over-the-counter drugs prescription Groceries Gasoline household paper products and most types of clothing and. Current HST GST and PST rates table of 2022. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate.

Just enter the five-digit zip. The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Here is how the total is calculated before sales tax. Tax rate for all canadian remain the same as in 2017. New Jersey has a 6625 statewide sales tax rate.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Enter the sales tax percentage. It is 429 of the total taxes 379 billion raised in New Jersey.

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. New Jersey has a 6625 statewide sales tax rate but also has 308 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0003 on. This app is especially useful to all manner of professionals who remit taxes to government agencies.

New Jersey has a single. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. New Jersey State Sales Tax.

Why A Reverse Sales Tax Calculator is Useful. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

Sales tax calculator to reverse calculate the sales tax paid and the net price. In the example above we have explained to you to calculate the Sales Tax amount payable in a product and the Gross Price of the Product. The only thing to remember in our Reverse Sales.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. This app is especially useful to all manner of professionals who remit taxes to government agencies. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. Sales Tax Rate Sales Tax Percent 100.

Sales Tax total value of sale x Sales Tax rate. Tax rate for all canadian remain the same as in 2017. Sales and Use Tax.

See the article. Amount without sales tax QST rate QST amount. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate Sales Tax In Excel Tutorial Youtube

Kentucky Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

Tip Sales Tax Calculator Salecalc Com

Us Sales Tax Calculator Reverse Sales Dremployee

State Corporate Income Tax Rates And Brackets Tax Foundation

New Jersey Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

Sales Tax Reverse Calculator Internal Revenue Code Simplified