2022 tax refund calculator with new child tax credit

An alternative sales tax rate of 6625 applies in the tax region Middlesex. 112500 if you are.

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

The increased child tax credit is reduced by 50 for every 1000 income above the thresholds.

. It will be updated with 2023 tax year data as soon the data is available from the IRS. The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes. The Child Tax Credit income limits are as follows.

Once you have a better understanding how your 2022 taxes will work out plan accordingly. This 2022 tax return and refund estimator provides you with detailed tax results. Single filers may claim 13850 an increase.

This 2022 tax return and refund estimator provides you with detailed tax results during 2022. Incentives depend on the HERS score and the classification. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds.

The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for. The average cumulative sales tax rate in Piscataway New Jersey is 663. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

The EIC reduces the amount of taxes owed and may also give a refund. 2022 tax refund calculator. 2022 tax refund calculator with new child tax credit.

NJ Clean Energy- Residential New Construction Program. For your 2022 tax return the potential return per dependent aged. For instance if you are filing for a single return and your.

Once you have a better understanding how your 2022 taxes will work out plan accordingly. The IRSstarted accepting tax returns on January 24. The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes.

Last year the IRS increased the potential payout of the Child Tax Credit to 3600 per child up from 2000 the year prior. Have been a US. Tax Credits Contact Details.

Prepare and e-File your. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

45 Knightsbridge Rd Ste 22. 25900 1400 1400 1400. Find Tax Credits Location Phone Number and Service Offerings.

This includes the rates on the state county city and special levels. The maximum child tax credit amount will decrease in 2022. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

As a result their 2022 standard deduction is 30100. Tax Credits Phone Number. On their 2023 return assuming there are no changes to their marital or vision status.

The latest round of federal stimulus was worth up to 1400 while the child tax credit increased to a maximum of 3600. Piscataway is located within Middlesex County. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Taxes 2022 Child Tax Credit Stimulus Checks Impact 2022 Tax Refunds

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Refund Calculator Estimate Refund For Free Taxslayer

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Tax Year 2022 Calculator Estimate Your Refund And Taxes

2022 Tax Refund How Child Tax Credit Affects Colorado Parents Denver Co Patch

2022 Tax Refund How Child Tax Credit Affects Mn Parents Across Minnesota Mn Patch

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Earned Income Tax Credit Estimator Get It Back

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Are Marriage Penalties And Bonuses Tax Policy Center

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

What You Need To Know To File Taxes In 2022 Get It Back

Get Up To 3 600 On The Child Tax Credit Even If You Already Missed It

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

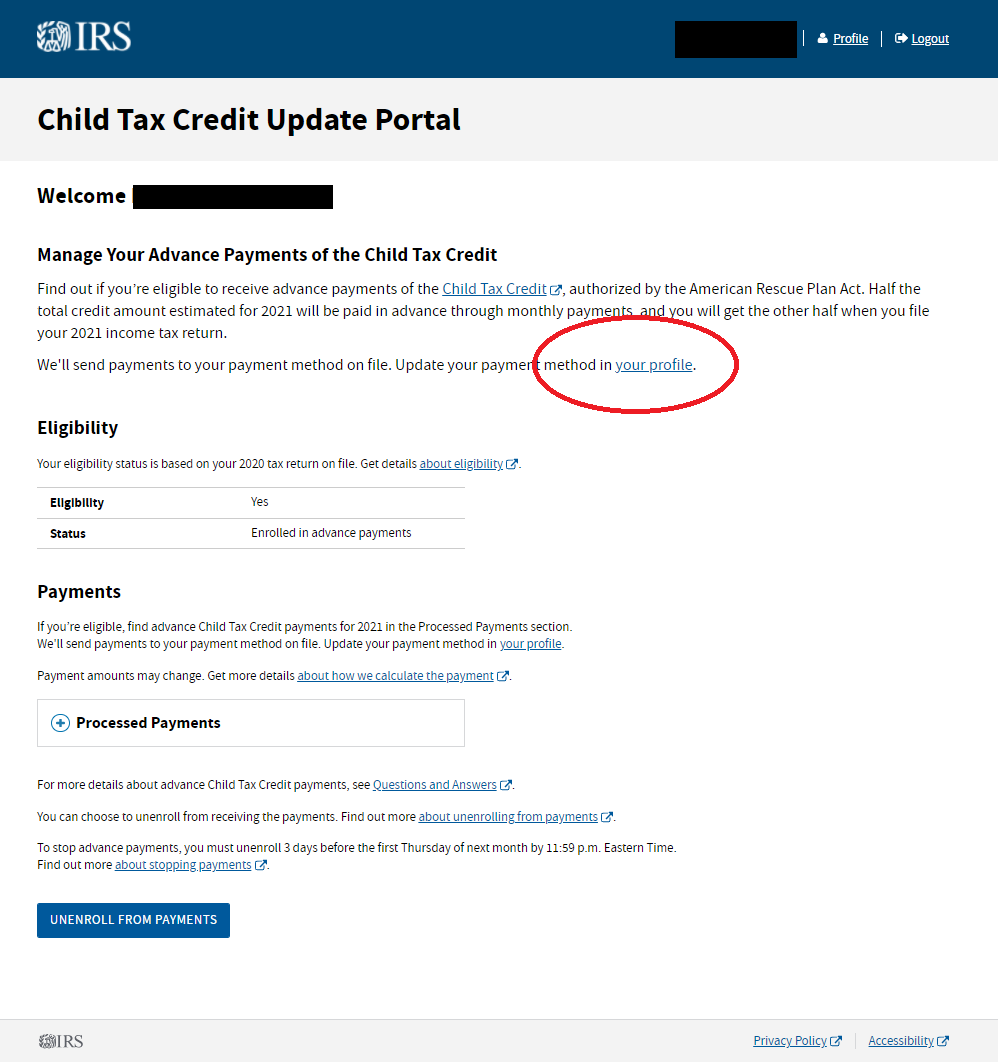

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back