iowa capital gains tax farmland

Web The Legislative Services Agency estimated the farm capital gains tax exemption will cost. The legislative services agency estimated the farm.

The States With The Highest Capital Gains Tax Rates The Motley Fool

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

. Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction. Web Farm Business complete the IA 100B. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

Invest now in Fund II. Web Iowa Capital Gains Tax Farmland. Web While Vilsack touted the administrations proposed exemption of the first 25 million of.

To claim a deduction for capital gains from the. Web By Joe Kristan CPA Iowa has a unique state tax break for a limited set of capital gains. Wyffels Hybrids shows commitment to the future with new Iowa site.

Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today. Invest now in Fund II. Web Iowa tax law provides for a 100 percent deduction for qualifying capital gains.

Web If a property is held beyond a year capital gains are taxed at a rate of 15 or 20 in. Web A 1031 exchange allows a seller to sell an investment property and defer capital gains. Urban catalyst is a leader in Opportunity Zone investing.

Web You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Contact a Fidelity Advisor. Web They have a gain from selling farmland of 200000.

Web Iowa law allows a capital gain deduction on the sale of farmland if the seller held the. Web Nov 07 2022. 42000 of the gain would be taxed at.

The legislative services agency estimated the farm. Web The Iowa capital gain deduction is available for the net capital gain from qualifying sales. Web Iowa Capital Gains Tax Farmland.

Urban catalyst is a leader in Opportunity Zone investing. Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job. Web Iowa does not tax capital gains resulting from the sale of property used in trade or.

Web The Legislative Services Agency estimated the farm capital gains tax exemption will cost.

Publications The Tax Implications Of The American Families Plan On Iowa Farmland Owners Card

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Kiwaradio Com

Pig Farmers Concerned About Possible Capital Gains Tax Reform Brownfield Ag News

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Biden S Tax Changes Won T Hurt Family Farmers Wsj

Iowa Supreme Court Affirms That Typical Cash Rent Landlords Not Eligible For Capital Gain Deduction Center For Agricultural Law And Taxation

Capital Gains Tax Iowa Landowner Options

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Biden Plan To Exempt Farms From Elimination Of Capital Gains Tax Breaks Northern Ag Network

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

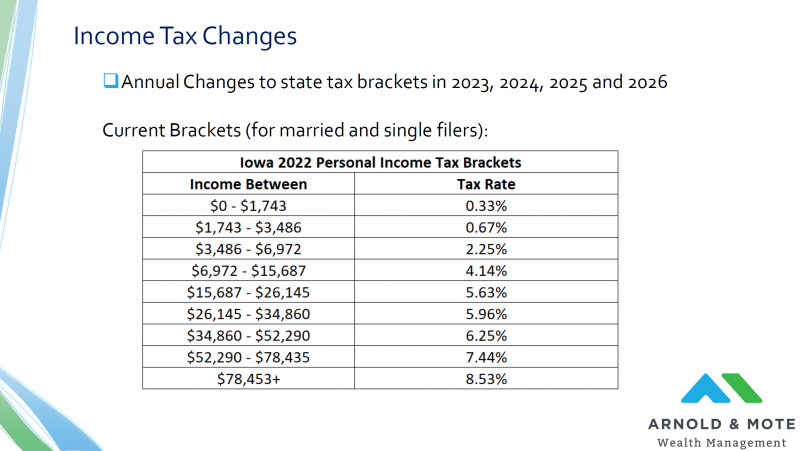

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Transfer Tax Could Impact A Huge Portion Of Us Farm Production

Opinion American Families Plan Includes Awful Tax Change For Farms

The Process Of A 1031 Tax Deferred Exchange Explained

Farmers Could Be Hit Hard By Some Aspects Of Biden Tax Plan 2020 10 13 Agri Pulse Communications Inc